April 27, 2025 · 5 minutes read

Key Elements for Businesses

Go directly to the power of attorney

How to create a business mandate

A mandate (or power of attorney) is essential for a representative to act on behalf of the company at the SAAQ.

Important: The SAAQ does not provide a standard power of attorney form for businesses; companies must draft their own document.

The mandate must be precise, complete, and signed by an authorized person in the company.

Verification by the SAAQ includes the mandate document and the representative's identity.

Businesses vs Individuals

For individuals: You must use the official form provided by the SAAQ for personal transactions available here.

Understanding the Business Power of Attorney for Vehicle Transactions at the SAAQ

For a business in Quebec, managing the purchase, sale, or registration of vehicles may require delegating these tasks to an employee or third party. The mandate, often referred to as a power of attorney in this context, is the legal document that authorizes a person (the representative) to act on behalf of the company (the principal) with the Société de l'assurance automobile du Québec (SAAQ). Unlike individuals who have a specific SAAQ form, businesses must create their own mandate document. Mastering this process is crucial to ensure compliance and efficiency in your company's vehicle transactions.

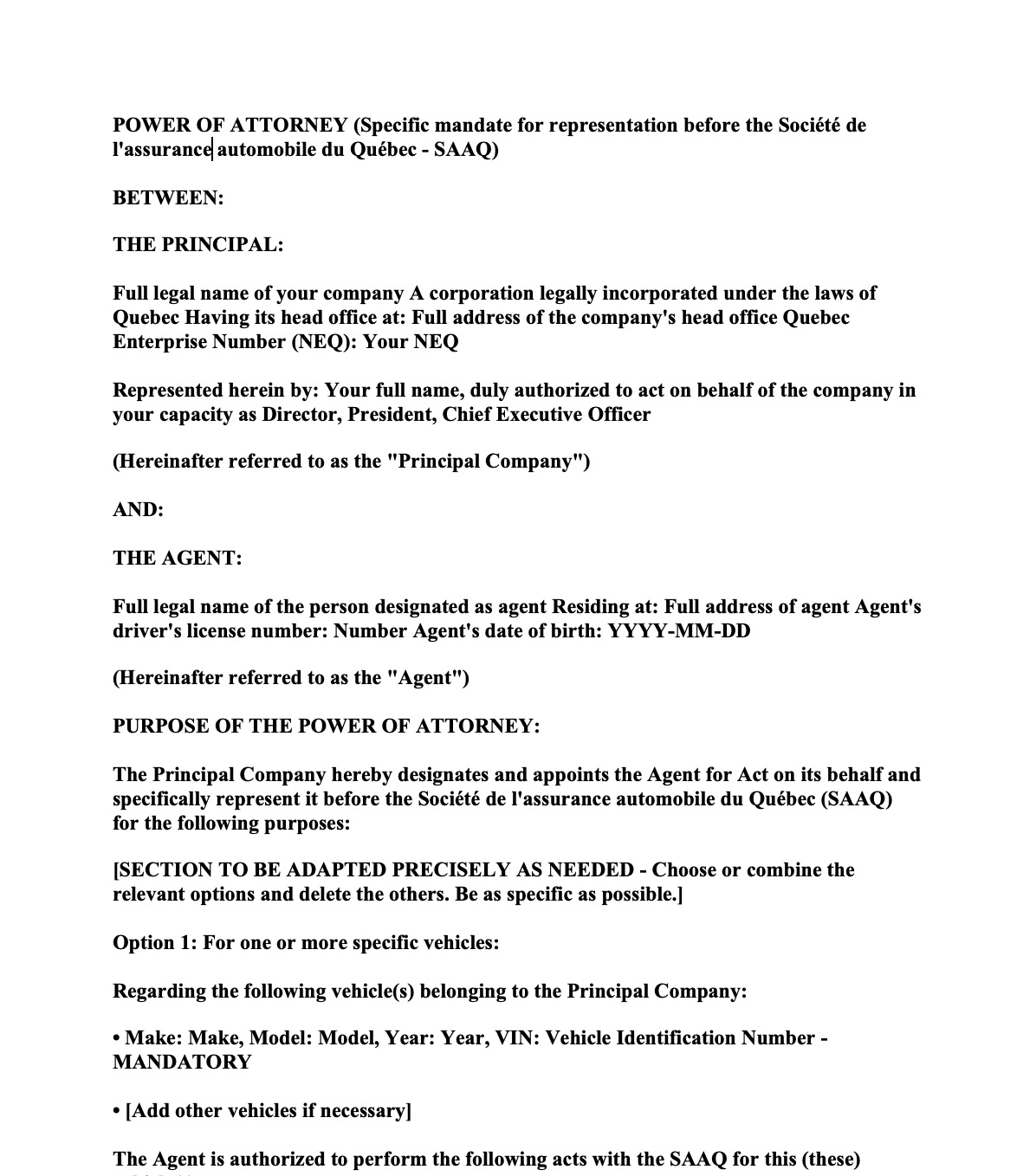

Download and Filling the Free Form

The power of attorney form is available here in PDF format, which facilitates access and completion.

Download the free SAAQ power of attorney form:

Creating and Content of the Business Mandate

Since there is no official SAAQ form for businesses, you must draft a mandate on company letterhead. This document must be clear, precise, and contain the following information:

- 1. Complete identification of the company: Legal name, address, and Quebec Business Number (NEQ).

- 2. Complete identification of the representative: Full name of the person authorized to act for the company (as indicated on their valid ID).

- 3. Clear description of the authorization: Specify the or transactions permitted (e.g., "sell the vehicle", "register the vehicle", "transfer the vehicle's ownership").

- 4. Vehicle identification (if applicable): Make, model, and vehicle identification number (VIN). For more general mandates (e.g., registering all new vehicles), the scope must be clearly defined.

- 5. Date of creation of the mandate.

- 6. Signature of an authorized representative of the company: An administrator, director, or any other person with the authority to bind the company (verifiable via the Registry of Enterprises). The title of the signatory must be indicated.

There is no PDF form to download for businesses. The mandate must be an original document created by the company.

Use of the Mandate

The designated representative must present the original signed mandate, as well as a valid official ID (driver's license, passport, etc.), when presenting at the SAAQ service point to perform the transaction on behalf of the company.

Table of Contents:

- What is a business power of attorney for the SAAQ?

- How to create the business power of attorney

- Why to appoint a representative for your business?

- Responsibilities (Insurance, Transfer) for the business

- Transaction process via representative at the SAAQ

- Key points for business vehicle transactions

- Conclusion

- FAQ for businesses

What is a business power of attorney for the SAAQ?

Definition and importance

A mandate, also known as a power of attorney, is a legal act by which a person or entity (here, the company, called the principal) grants a specific person (the representative) the power to act on its behalf to perform specific legal or administrative acts. It is a fundamental tool for delegating authority that allows a company to function effectively by enabling representatives to make commitments on its behalf.

In the context of vehicle transactions, it is precisely this type of document (the mandate or power of attorney drafted by the company) that is used to authorize a representative to perform specific tasks with the Société de l'assurance automobile du Québec (SAAQ). These tasks can include the purchase, sale, registration, or transfer of a vehicle owned by the company. Its use becomes essential to ensure the legal validity of these operations, especially when the directors, administrators, or other authorized signatories of the company are not available to perform these transactions themselves.

When to use a business mandate?

This mandate is necessary whenever a person other than an administrator or director (whose authority is verifiable via the Registry of Enterprises) must perform a vehicle transaction for the company. This includes employees (fleet manager, administrative staff) or even a trusted third party.

How to create the business power of attorney?

Required elements

As detailed above, ensure that the document created by the company includes:

- 1. Complete information of the company (Name, address, NEQ).

- 2. Complete information of the representative (Name, address).

- 3. Clear and precise authorization (nature of the transaction).

- 4. Vehicle details (VIN, etc., if applicable).

- 5. Date.

- 6. Signature of an authorized person in the company (with title).

Tips for validity

Use official company letterhead. Ensure that the person signing for the company has actual authority (verifiable at the REQ). Be precise about the scope of the mandate to avoid ambiguity. Keep a copy of the mandate in the company's files.

Why appoint a representative for your business?

Role of the representative

The representative acts legally on behalf of the company for the tasks specified in the mandate. It engages the company's responsibility during the transaction.

Benefits for the business

Designating a representative allows directors to focus on other activities. It optimizes fleet management and ensures the continuity of operations (e.g., quick registration of new service vehicles).

Common example of use

A construction company regularly purchases new trucks. To avoid the president having to go to the SAAQ each time, the company drafts a mandate authorizing the fleet manager to register all new vehicles purchased on behalf of the company. The fleet manager presents at the SAAQ with the mandate, the purchase contract of the truck, and his ID to complete the registration.

Responsibilities (Insurance, Transfer) for the business

Automobile insurance

The company owning the vehicle is responsible for maintaining the minimum mandatory liability insurance (for property and bodily damage caused to others) as long as the vehicle is registered under its name. During a sale, the selling company must maintain its insurance until the vehicle's ownership is officially transferred at the SAAQ. The purchasing company must ensure it has a valid insurance policy before taking possession and registering the vehicle.

Transfer of ownership

When a company buys or sells a vehicle, the key steps include signing a sales contract (recommended), handing over the registration certificate, and especially, the official transaction at the SAAQ (performed by the representative if applicable) to transfer the registration. Applicable taxes (TVQ) must be managed in accordance with business tax rules.

Transaction process via representative at the SAAQ

Procedures at the service point

The representative goes to the SAAQ service point with:

- The original signed mandate by the company.

- His valid ID with photo.

- All other required documents for the transaction (current registration certificate, sales contract, mechanical inspection certificate if necessary, etc.).

- Payment methods for applicable fees and taxes.

The SAAQ will verify the mandate, the representative's identity, and the vehicle documents before proceeding.

Vehicle ownership transfer: key steps

SAAQ process

The ownership transfer process requires completing specific administrative procedures at an SAAQ service point, including updating registration and declaring the transaction, with required registration fees.

2025 Registration Fees:

In 2025, registration fees in Quebec underwent significant changes:

- Quebec City: Approximately $300 for a passenger vehicle (public transit tax increased from $30 to $90)

- Greater Montreal: Approximately $400 (public transit tax increased from $59 to $150 + $30 for CMM)

Note: Fees for motorcycles and trucks may vary. Consult the SAAQ website for complete details.

* Remember that registration fees may be higher if you have demerit points on your driving record.

Responsibilities of previous and new owner

When transferring vehicle ownership in Quebec, the responsibilities of the previous and new owner are clearly defined. The previous owner must remove license plates, update their address with the SAAQ, inform them of the sale, provide the registration certificate and sales contract to the buyer, and pay transfer fees. The new owner must obtain new registration, get insurance, pay registration and transaction fees, inform the SAAQ of the acquisition, and keep sales documents. Together, they must ensure the transfer is completed within 30 days of sale, that the vehicle is safe, and report any incidents to the SAAQ. Failure to comply may result in penalties. For more information, consult the SAAQ website and the Office de la protection du consommateur.

Selling a vehicle: what you need to know

Preparing the sale

Before selling your vehicle, make sure all required documents, including the power of attorney, are in order.

Post-sale formalities

After the sale, procedures like notifying the SAAQ and updating insurance are required.

The private vehicle sales contract is not mandatory but highly recommended.

Latest SAAQ updates

https://saaq.gouv.qc.ca/salle-presse/actualites

By mastering these elements, you'll ensure a smooth and compliant transaction when selling your vehicle.

Conclusion

The SAAQ power of attorney simplifies vehicle sales in Quebec, ensuring a secure and regulated transaction. Understanding this document is the first step for sellers and buyers to facilitate a smooth ownership transfer.